TANGO Partners Perspective – April 2021

Environmental, Social and Governance Investing

Written by: Ben Kille, Principal

Private Capital Group, LLC

Environmental, Social, and Governance Investing, also called Impact Investing and previously known as Socially Responsible Investing, refers to three central factors in measuring sustainability and societal impact of an investment in a company or business. This umbrella term for investing seeks not only positive returns, but long-term positive impacts on society, environment, and the performance of the business.

Align, Integrate, and Allocate:

After understanding a nonprofit organization’s investment goals, a financial advisor will work them to integrate ESG into the investment portfolio through a combination of aligning, integrating, and allocating.

Aligning a nonprofit’s values with their investments to minimize exposure to companies or industries whose business practices conflict with the organization’s values and convictions.

Integrating ESG factors into investment decisions to identify and emphasize investments in companies or industries with positive ESG practices or that limit exposure to those companies or industries with poor ESG performance.

Allocating investments within portfolios to target specific environmental or social objectives that complement the organization’s philanthropic efforts.

ESG Criteria:

ESG criteria are a set of standards for a company’s operations that socially conscious investors use to identify potential investments. Environmental criteria deem how a company performs as a steward of nature and natural resources. Social criteria assess how a business manages relationships with their employees, suppliers, customers, and the communities in which they operate. Governance criteria evaluates how a company deals with a company’s leadership, board transparency, executive pay, audits, internal controls, and shareholder rights. These criteria are becoming increasingly popular evaluation methods for investors to gauge companies where they may want to invest. Independent research continues to show that these factors are financially material to the long-term performance of companies across sectors and geographies.

Myths vs. Realities:

A relatively new investment concept, ESG investing has been faced with reluctance from many financial advisors. But what are a couple of the common misconceptions surrounding ESG investing?

“Sustainable investing is a fad; most investors are not interested.”

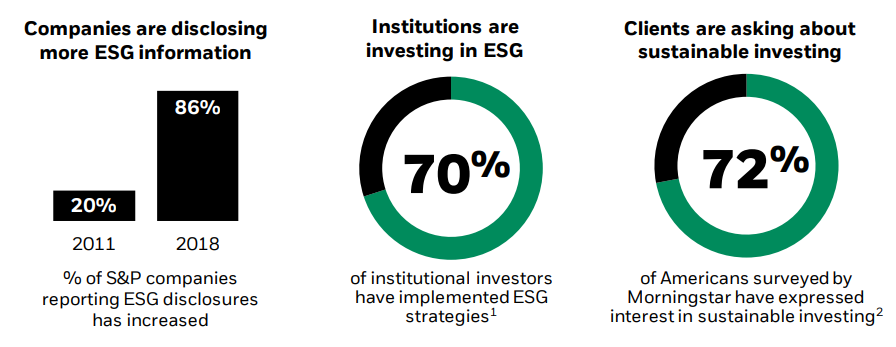

In fact, many different types of investors are becoming increasingly interested in ESG investing. Sustainably invested assets grew an estimated 34% worldwide, and 42% in the U.S. between 2018-2020. Millennials, Generation Xers, and women are leading the charge in terms of interest in sustainable investments, but investors in all demographics are overwhelmingly interested in aligning portfolios with their values.

“ESG investing will hurt my overall financial performance.”

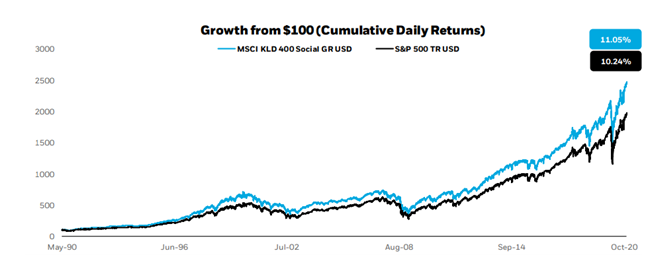

When implemented in a well-executed investment strategy specifically designed for an organization, sustainable investors can achieve at- or above-market returns over the long-term. Companies that better manage their ESG risks often have less systemic volatility than their conventional peers. In the below chart, you will see that ESG funds can even outperform their non-ESG peers.

ESG Fund Performance vs. Overall Stock Market:

One reason some investors avoid ESG is the perception that ESG falls behind in terms of performance of the S&P 500. As we view the graph above, that is not historically the case. The MSCI KLD 400 Social Index, launched in 1990, is one of the earliest index funds that was designed to help socially conscious investors weight social and environmental factors in their investment choices. Over the course of the past 30 years, we see that the MSCI KLD 400 has performed slightly better than the S&P 500. The notion that ESG funds do not perform up to par with standard index funds is not always the case.

ESG Recognition for Sustainability:

Over the past decade, many more companies are not only beginning to report ESG disclosures, but institutions are also investing more in ESG. Now that more resources, disclosures, and data are coming out to help investors make wise investment decisions that align with their values and goals, many more organizations are beginning to express interest in sustainable funds and how to incorporate these funds into their investment portfolios.

Is ESG Investing right for you?:

If you would like to learn more about how your organization can embark on Environmental, Social, and Governance Investing, do not hesitate to reach out to Private Capital Group. Private Capital Group knows the importance of aligning your organization’s mission, vision, and long-term goals with your investment and portfolio strategy. Private Capital Group believes in providing clients with valuable insight into companies that build strong corporate brands through promotion of sustainable long-term growth for the better good.

Sources:

- Data from 5/30/1990 – 12/31/2020. MSCI KLD 400 Social Index Inception: 5/1/1990. There may be material differences between the fund’s index and the index shown including without limitation holdings, methodology and performance. The numbers in the bubbles represent annualized return over a period of time. Index performance is for illustrative purposes only. Index performances does not reflect any management fees, transaction costs, or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results. Index performance does not represent actual iShares Fund performance. For actual fund performance, please visit www.iShares.com or www.blackrock.com. 1 Source for the ETF metrics: MSCI ESG Fund Ratings as of 10/7/2020, based on holdings as of 8/31/2020. Source for the index: MSCI ESG Research as of 10/1/2020, based on holdings as of 9/1/2020. The parent index of DSI’s index is the MSCI USA IMI Index (99.81% of securities covered by MSCI Research).

- 2018 Morgan Stanley Survey: https://www.morganstanley.com/press-release/morgan-stanley-finds-sustainable-investing-momentum-high-.

- Morningstar: Are Your Clients ESG Investors?, April 22, 201

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Private Capital Group, LLC (“PCG”), or any non-investment related content, made reference to directly or indirectly in this communication will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Information contained in this communication is based on data gathered from what we believe are reliable sources. It is not guaranteed by PCG as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. Further, you should not assume that any discussion or information contained in this communication serves as the receipt of, or as a substitute for, personalized investment advice from PCG. To the extent discussed herein, investment indices are unmanaged and cannot be purchased directly. Historical performance results for investment indexes and/or categories are included for informational purposes only and generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the US stock market. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PCG is neither a law firm nor a certified public accounting firm and no portion of the communication should be construed as legal or accounting advice. A copy of the PCG’s current written disclosure Brochure discussing our advisory services and fees is available upon request.

Please Note: If you are a PCG client, please remember to contact PCG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. PCG shall continue to rely on the accuracy of information that you have provided.

Disclosure from our Author:

Investment advisory services offered through PCG, a registered investment advisor. This e-mail may include forward-looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. The above communication is written by Michael A. Higley. Any comments, opinions or facts listed are those of Mr. Higley.

CONTACT OUR

TANGO PARTNER

Ben Kille

Partner

Private Capital Group

860-561-1162 Ext. 1842

View Special offers to TANGO Members!