TANGO Partners Perspective – August 2023

Impact Investing: Why it Matters for Investors

Benjamin D. Kille, CFP®, CIMA®, AIF®, Managing Director

Wealthspire Advisors

What is “Impact Investing”?

While the term was coined just over a decade ago, all investments have always had some sort of impact, even if those impacts were not fully known, desired, or measured. We abide by the Global Impact Investing Network (GIIN)’s widely accepted definition of impact investments: Investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. It is important to underscore the financial return aspect, which will be explored further. Impact investing should be thought of a lens applied to all asset classes – public & private equity, fixed income, private debt, venture capital, and real assets/alternatives – and not as a standalone asset class.

Impact investing is on the rise among investors around the globe, so much so that The World Economic Forum, Barron’s and leading Wall Street money managers have all pronounced that “impact investing has gone mainstream.” This view is backed by evidence of growing demand among investors: at the beginning of 2020, assets under management in the U.S. that used impact investing strategies totaled $17 trillion dollars, representing 33% of total U.S. assets.1

In summary, impact investing is integral to a holistic investment decision-making framework in which values, mission and measure of impact are considered in concert with, and enhance the assessment of, investment return and risk parameters.

Why Impact Investing Matters for Investors

Values Alignment

Investors are generally becoming more conscious of the ill effects of climate change, the importance of product safety, and the benefits of cleaner sources of energy, social inclusion, workplace fairness and community development. With this growing awareness, individuals and institutions seek to align more of their investments with their core values and/ or mission. Foundations often seek to align 100% of their capital with their mission, rather than just the 5% grant capital, by using impact investments for their endowment. Through values alignment, investors can have greater comfort in the investments they own, especially when the financial performance is equal to non-aligned investments.

Value Creation

There is increasing evidence that investing with an impact lens, i.e. considering environmental, social and governance (ESG) factors, enables investors to spot companies with an ethos of long-term value creation. Such enterprises are better at innovating, cost management, employee retention, and mitigating risks to their operations, reputation and brand that arise from causing environmental damage (E), the unequal treatment of employees (S), or the violation of safety regulations

(G). Over time, brand reputation helps such companies attract the best talent and establish a loyal customer base, with a corresponding enhancement of its financial performance.

Risk Mitigation

There is also growing evidence of a correlation between high scores for Environmental, Social, and Governance (ESG) factors and risk mitigation. A November 2017 MSCI study found strong evidence that companies with strong ESG profiles are better at managing both investment risks and opportunities. And based on an analysis performed by Bank of America and Merrill Lynch, an investor who only held stocks with above-average ranks on both environmental and social scores would have avoided 15 of the 17 bankruptcies we have seen since 2008.

History, Timeline, and Trends

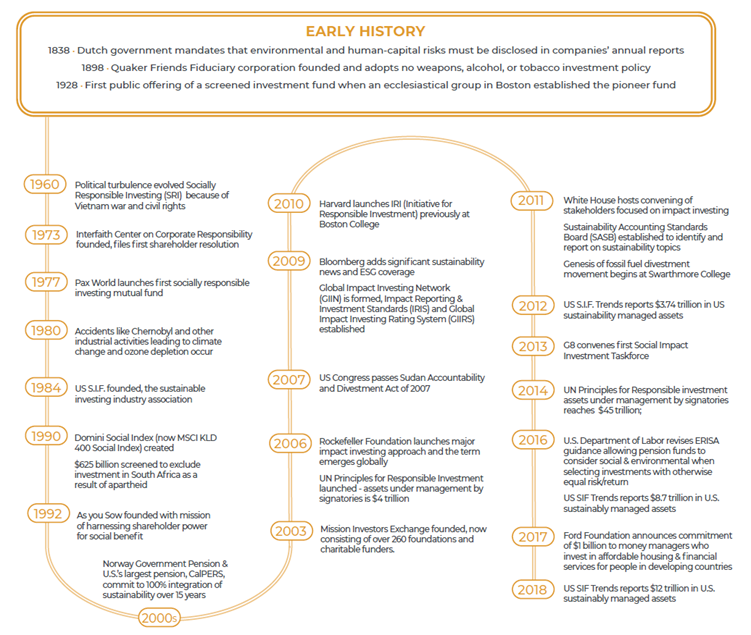

Impact investing is far from a new concept and dates back several centuries. The term Responsible Investing, a precursor to impact investing, considered the social impacts of investing dating back to the late 1890s when the Quakers restricted members from spending time or money in the slave trade. While early practices in responsible investing were purely exclusionary in nature, the timeline below depicts both the evolution of and the foundation for today’s accelerating demand for the more holistic impact investing. In fact, many investors are taking part, and women and millennial investors are fueling much of the demand. In the U.S., the appeal of Impact Investing significantly increased to 61% in 2021, compared to 51% in 2020 with the highest appeal among Millennials (66%), followed by Gen X (64%).2

Most Common Myths About Impact Investing

Myths and labels have discouraged some individuals and institutions from exploring the benefits of impact investing and incorporating it into their investment practices. Adopting GIIN’s widely accepted definition can dispel the label confusion, and the time has come to dismiss myths and to lever the potential advantages of impact assessments in investment decision making.

Myth #1: Selecting Investments that Align with Values Means a Sacrifice in Returns

Many investors still falsely believe the myth that any attempt to either avoid negative ESG externalities and/or to seek positive social impacts when investing automatically means sacrificing returns. In theory, any constraint on an investment universe should present return headwinds and increase portfolio risk. However, empirical evidence has shown that investment funds and strategies that incorporate “restrictive” screens have shown little ill-effect relative to traditional mandates.

In a 2015 study that reviewed 2,200 academic papers on investing that use all or some of the ESG subcomponents, nearly half of papers found ESG investing to be a net positive. Roughly 10% found such investing to be negative, and the other 40% mixed or neutral. These findings reinforce long-standing evidence about the relationship between good governance, superior management, quality product and services and bottom-line financial performance3. In fact, increasingly, investors have come to understand that they can achieve market-rate returns through the very pursuit of investments that yield positive ESG returns. “In a “rigorous survey of 53 impact investing private equity funds from around the world,” Wharton Social Impact Initiative concluded that “concessionary financial returns were not required to preserve the social or environmental effect of impact investments.”3

Myth #2: Impact Investing is not for Serious Investors

Myth #2: Impact Investing is not for Serious Investors

With Impact Investing undergoing a “broadening of the tent” in recent years, world-class investors, respected financial institutions, private equity and venture funds have all entered the space.

The fact that major pension funds, insurance companies and financial institutions are signatories of the Principles of Responsibility Investing (PRI) and readily use ESG analysis to supplement security selection is further evidence that this type of investing is good business and likely to be enduring. Leading long-time investment professionals have become steadfast proponents of its broader adoption, including Robert Litterman (codeveloper of the now widely used Black-Litterman Global Asset Allocation Model).

Myth #3: ESG Investing is a standalone practice focused on moral responsibility

In fact, issues within the ESG framework are often used by traditional investment managers as non-monetary metrics, which complement traditional fundamental analyses. According to a study by the University of Oxford and Arabesque Partners in March 2015, firms with higher ESG scores enjoy lower costs of debt and equity capital. In actual practice, contemporary techniques blend factors traditionally associated with values (morals/ethics) along with others based more on values (financial).

Approaches to Impact Investing

At the most simplistic level, the techniques applied to execute on impact investing strategies or approaches can be simplified into owning (inclusionary) and avoiding (exclusionary), i.e., what a client wants to own and what a client does not want to own based on their values, risk tolerance and goals. Both owning and avoiding are fairly straightforward, although the approaches differ on a variety of fronts.

Owning can range from separating the broad investment universe into companies/entities that align with one’s views, to specifically targeting individual themes, impact areas, companies in need of change, and other direct investments. In most cases, owning is not a passive exercise. Funds often exercise their shareholder/ownership rights through proxies, shareholder resolutions, and other mechanisms. To further define all of the strategies, we have sub-divided the universe into the following categories.

Positive Screening/Selection – Investing in securities that closely align with a subset of values and / or that seek a positive

ESG return, e.g., clean energy technologies, religious values, or diversity and inclusiveness.

Negative Screening/Exclusion – Avoiding securities, companies or industries that do not align with a subset of values or that have negative social or environmental impacts, e.g., securities that finance guns, tobacco, human trafficking, fossil fuels and companies that undermine human dignity, are known for poor governance and safety, or have workplace biases against women or selected ethnic groups.

Alignment / ESG Integration – This approach combines elements of positive and negative screening and focuses on the overall materiality of a security’s impacts through ESG factor analysis and scoring. ESG factors are integrated into the overall financial analysis to identify companies that have sound governance, strong workforce policies and resource- efficient practices. This approach is frequently used by managers without a specific ESG/SRI mandate, increasing the reach of ESG factors within the investing world.

Shareholder/Stakeholder Engagement – Investors are using shareholder proxies to influence corporate policies and practices. Some investors and money managers also file or co-file corporate resolutions with the intent of placing specific issues on shareholder ballots. Activist investors seek, for example, to advance equal pay for women, diverse corporate boards, better benefits for employees and adoption of more environmentally sustainable business practices.

Thematic Intentionality & Direct Investments – Some investors target specific impact themes and scan opportunities to achieve impact across all asset classes, with most thematic alignment often coming from private equity and private debt investments. This can take the form of micro-lending to women in the developing world, equity and debt financing of small businesses establishing new distribution of potable water in Sub-Saharan Africa, or community development debt instruments for inner city affordable housing in the United States. Impact investors are also employing specific screens or lens on public securities such as gender equality and the advancement of diversity and inclusion. Thematic investments are also not limited to ESG factors and can be based on trends that are likely to persist long into the future, such as climate change.

Wealthspire Advisors’ Impact Offering

Wealthspire Advisors focuses on strategies that encompass many of the prevailing impact and ESG themes that have broad appeal.

The approach to impact investing is similar in many respects to any other kind of investing. The starting point is the client and their wishes, which is no different than considering their performance objectives, liquidity, and risk tolerance. In our view, impact investing is grounded in an individual’s values or an institution’s mission. Hence, we believe that the starting point for any approach to impact investing is in the client discovery process.

We believe that what matters most are the values of the investor. As each investor has unique values and goals, no one metric will determine if an investment is right for them. Wealthspire’s holistic approach to impact investing looks to understand the needs of our clients and use impact investing as a decision-making framework applied across a client’s entire portfolio.

A Note from the Author

The landscape for ESG investing is being challenged on many fronts today. There is a concern that a few major financial institutions have immense voting powers based on their holdings in index funds and exchange traded funds. This voting power can be utilized to influence outcomes that may not conform to individual investor preferences. In addition, some states, with oversight on state pensions, question if by following ESG principles, the investment strategies are fully diversified and abiding by their fiduciary responsibilities to those impacted by these decisions. For those people who can direct their own investments and have unique personal ESG objectives, there are meaningful solutions to those desires.

As the industry evolves, there is a growing focus on standardization, a trend we expect to continue. We applaud efforts by the Sustainability Accounting Standards Board (SASB), an independent organization that sets standards to guide the disclosure of financially material sustainability information by companies to their investors. Its standards identify the subset of ESG issues most relevant to financial performance in 77 different industries. Beyond helping publicly traded companies manage and measure ESG factors, SASB standards can also help individual investors by providing them with comparable, standardized data to inform their investing decisions.

To learn more about our perspectives on ESG and Impact Investing, don’t hesitate to reach out.

To download a printable copy of this information, click here.

2 American Century Investments – The Growing Appeal of Impact Investing Contrasting U.S., UK, Germany, and Australia Attitudes, May 2022.

3 Wharton School, Great Expectations: Mission Preservation and Financial and Performance in Impact Investing, 2016.

Wealthspire Advisors LLC is a registered investment adviser and subsidiary company of NFP Corp.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, Certified Financial Planner™, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute® (the Institute) is the owner of the certification marks “CIMA®” and “Certified Investment Management Analyst®.” Use of CIMA®, and/or Certified Investment Management Analyst® signifies that the user has successfully completed the Institute’s initial and ongoing credentialing requirements for investment management professionals.

The Center for Fiduciary Studies owns the mark AIF®, which it awards to individuals who successfully complete initial and ongoing accreditation requirements.

This information should not be construed as a recommendation, offer to sell, or solicitation of an offer to buy a particular security or investment strategy. The commentary provided is for informational purposes only and should not be relied upon for accounting, legal, or tax advice. While the information is deemed reliable, Wealthspire Advisors cannot guarantee its accuracy, completeness, or suitability for any purpose, and makes no warranties with regard to the results to be obtained from its use. © 2023 Wealthspire Advisors

CONTACT OUR

TANGO PARTNER

Ben Kille, CFP®, CIMA®, AIF®

Managing Director

Wealthspire Advisors

Phone: (860) 561-1162 Ext. 1842

Email:

Website – wealthspire.com