Jack's Journal - November 2021

The Nonprofit Sector’s Special Sauce

Jack Horak

Director of Nonprofit Education & Consulting

TANGO

The trainings consist of three live Zoom sessions of ninety minutes each based on the first eight chapters of our textbook, The Tango Nonprofit Method.

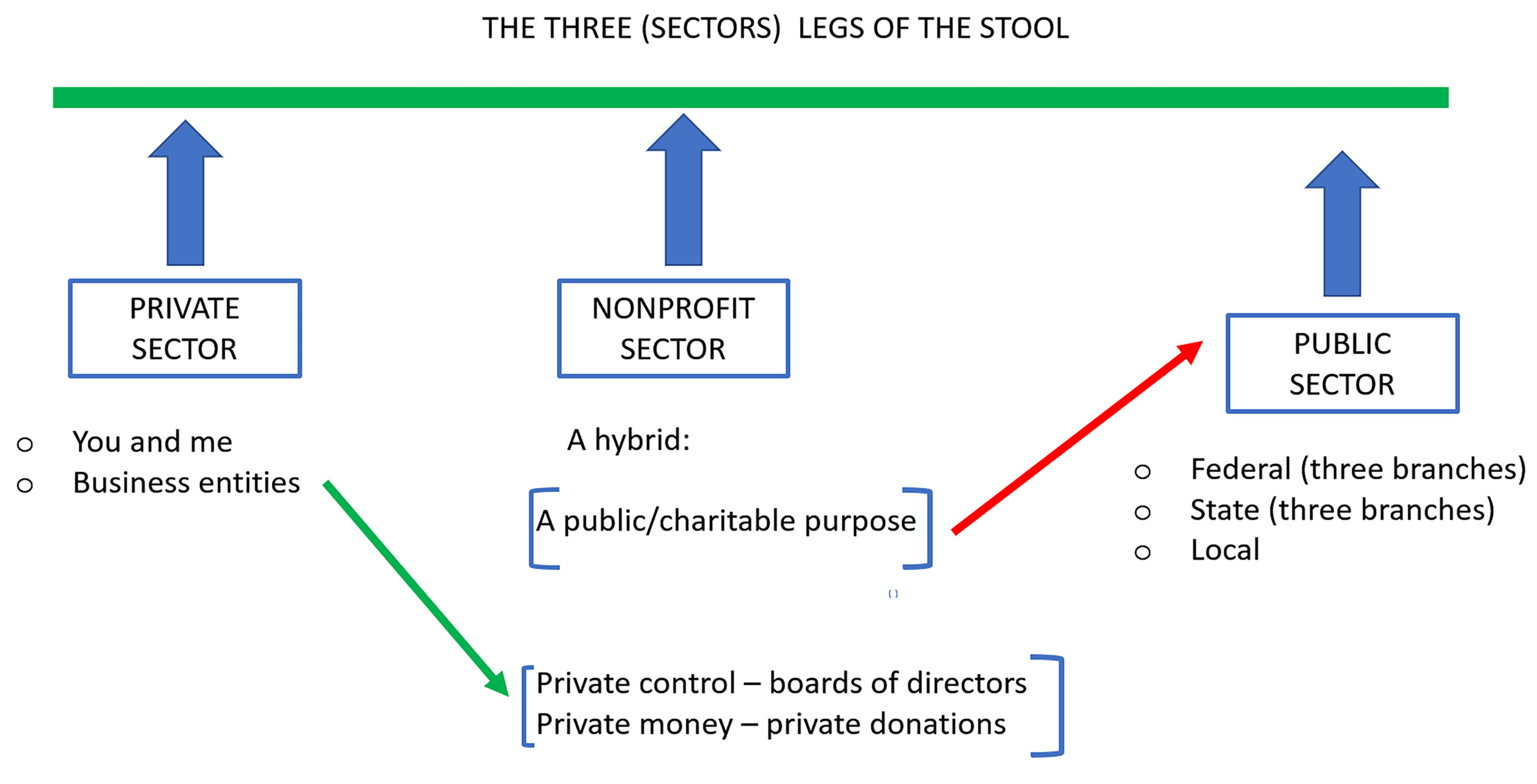

As I think back to the questions and discussions during these sessions, I suggest that perhaps the most poignant information provided to students is contained in a slide (reprinted below) that I developed to explain what I refer to as the “special sauce” that makes the nonprofit sector such an engaging and interesting sector place to be.

The special sauce is illustrated by the red and the green arrows on the slide. The red arrow demonstrates that nonprofits must be organized and operated to fulfill a public (charitable) purpose in the same manner as federal, state, and local governments operate for the benefit of the public; but, as the green arrow indicates, nonprofits are governed by the private citizens who populate their governing boards and are also the recipients of private money which must be used for the designated charitable (public) purpose. The special sauce is the conceptual basis for the tax benefits nonprofits enjoy – no income tax on any net income and the deductibility (to the donors) of the amounts they contribute.

If any readers are interested in learning more about the information on this slide, the course, or the textbook, please contact me at .

October 2025 – Founders Forum by Rollin Schuster

It was another great year at our Building Bridges Nonprofit conference where Nonprofit Leaders, TANGO Partners, and Special Guests gathered at the Aqua Turf Club in Plantsville, CT for a full day of education, networking and fun.

The Rideshare Company

Oak Hill is Connecticut’s largest private nonprofit provider of disability services. For over 130 years, Oak Hill has advanced a mission of equity, independence, and full community inclusion for people of all ages and abilities.

CONTACT

TANGO

Jack Horak

Director of Nonprofit Education & Consulting

TANGO – The Alliance for Nonprofit Growth & Opportunity

135 South Road

Farmington, CT 06032

877-708-2646

tangoalliance.org